Giving back to the less fortunate is a rewarding experience. But, strategic charitable donations can provide significant tax advantages. By understanding the rules surrounding charitable deductions, you can optimize your tax savings while supporting causes that are important to you. Explore working with a financial advisor to develop a plan that matches both your philanthropic goals and your financial objectives.

- Don't forget to document contributions carefully throughout the year.

- Discover eligible charities and their missions.

- Utilize various donation methods, such as cash, stocks, or real estate, to boost your impact.

Strategic Philanthropy: Donate and Reduce Your Tax Burden

Smart giving isn't just about making a difference; it can also be a clever way to reduce your tax burden. By contributing to qualified charities, you can offset your income.

When filing your taxes, you can often deduct charitable donations from your income. This reduces your taxable income, potentially resulting in a smaller tax bill.

It's important to consult with a qualified tax professional to understand the specific rules and regulations surrounding charitable donations and their effect on your taxes.

Leverage Tax Benefits with Your Charitable Contributions

Giving back to your community through charitable contributions is a rewarding experience. However, did you know that your generosity can also provide valuable tax benefits? By strategically planning your donations, you can offset your tax burden.

One substantial benefit is the ability to claim charitable contributions from your taxable income. This can result in a apparent reduction in your overall tax obligation. It's important to maintain accurate records of your donations, including receipts and documentation of the recipient organization's status as a qualified charity.

To completely benefit from these tax incentives, it is highly advised to speak with a qualified tax professional. They can guide you on the best strategies for maximizing your charitable contributions and minimizing your tax burden. Remember, giving back should be both meaningful and financially sound.

Boost Your Charitable Impact through Tax-Deductible Giving

Making a difference in the world is a rewarding experience, and tax-deductible giving provides an opportunity to amplify your impact while also reducing your tax burden. By giving to eligible charities, you can claim valuable taxdeductions on your income. It's a win-win situation: you support important causes and reduce your fiscal expense.

- Examine the wide range of approved charities that align with your values and philanthropic goals.

- Review the foundation's mission, activities, and financialstatements before making a contribution.

- Store accurate proof of your contributions for tax purposes.

Consult from a qualified financial professional to optimize your tax benefits and ensure compliance with applicablelaws.

Unlocking Tax Relief: The Power of Charitable Donations

Charitable contributions are an effective tool for making a difference that align with your values. While the sense of purpose derived from aiding others are immeasurable, charitable donations also offer tax advantages. By subtracting your taxable income, charitable giving can result in significant reductions on your tax payment. donating money for tax purposes

This potential to lower your tax bill makes charitable donations an even more attractive choice for taxpayers who desire to maximize their impact.

Give Back and Save: Tax Advantages of Charitable Giving

Charitable giving is a wonderful way to contribute to causes you care about, but did you know it can also offer valuable tax benefits? By giving to eligible organizations, you may be able to lower your tax burden. The extent of these benefits fluctuates based on factors such as the amount donated and your earnings bracket.

- Talk to a tax advisor to explore the specific deductions available to you.

- Maintain detailed records of your gifts, including receipts and donation confirmations.

- Research eligible organizations to ensure they qualify for tax-deductible donations.

Alisan Porter Then & Now!

Alisan Porter Then & Now! Brandy Then & Now!

Brandy Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Elisabeth Shue Then & Now!

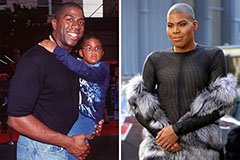

Elisabeth Shue Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now!